Last Updated: October 22, 2024

The process of buying a house can be overwhelming, let alone trying to figure it out in a foreign country. We have been living in Costa Rica for more than 10 years now and only recently purchased property. We did house sitting when we first arrived then we rented for a while. Finally, eight years in our move, we put down roots and bought our first house. In this post, we will give you an overview of the process of buying a house in Costa Rica. We’ll also share tips from our personal experience.

We are not lawyers in Costa Rica (though Jenn was one in the US) and are not intending to give legal advice. This post is meant to provide background on the process. Real estate transactions in Costa Rica do not always go smoothly, so always hire a local lawyer to guide you and advocate on your behalf.

Finding a Property

Online Options

Costa Rica does not have a multiple listing system (MLS), Zillow, or any similar real estate websites. This makes it more difficult to see what’s available online.

Real estate companies do have websites with listings, but these don’t include everything that is available. Lower priced homes, especially, tend not to be listed online. Some agents don’t have websites at all, while others have outdated information.

So how do you go about finding a house to buy in Costa Rica?

Real Estate Agents

Real estate in Costa Rica is mostly done on a local level. By that we mean that most real estate agents cover a specific geographic area, rather than the whole country.

That means that it’s easiest to first figure out the general area where you want to live. Once you know that, you can ask around to find a reputable local real estate agent.

If you’re not sure where to live, we have a couple of articles that may help. Check out:

Planning a Long-term Visit to Costa Rica – Includes tips on what the different regions of the country are like.

Where We’ve Lived in Costa Rica – Gives the pros and cons of eight different towns we explored in our first two years here.

One important tip on real estate agents: As a profession, real estate agents are not as regulated as in other places, like North America and Europe. They can be licensed, but it is not legally required. So you will find some real estate agents that have little to no experience or training. This makes it extremely important to talk to some locals in the area you want to live to see who they have used and if they had a good experience.

Making an Offer

Now that you’ve found a place you love, it’s time to start the legal process.

Just like in real estate transactions elsewhere in the world, the first step when buying a house in Costa Rica is to make a formal offer (also called a letter of intent). This is just a basic letter that gives your intent to purchase the property from the seller.

Deciding an Amount to Offer

One of the most important parts of the offer is that it gives the amount you want to pay.

When picking a number, your real estate agent should be able to give you some comparable properties in the area.

Be sure to factor in closing costs. These are around 4% of the purchase price, so can really add up.

Real estate transactions in Costa Rica are most often cash deals, especially if foreigners are buying. Banks in Costa Rica will not lend to non-residents. And for legal residents, interest rates are often too high to make it worthwhile. Because of this, most people do a cash deal. Sometimes sellers will offer owner financing, so that is an option if you need it.

Tip: Most people will tell you that it is a buyer’s market in Costa Rica, and you can usually offer much lower than the asking price. In our experience, that is true for the most part. However, since Covid, we have seen a dramatic increase in people coming to Costa Rica to live or have a second home. This has caused some local markets to have much less available, driving up prices. In the area where we were looking, near Jaco on the central Pacific coast, there were few options at a reasonable price.

Earnest Money Deposit

Another important component of the offer is the earnest money deposit. The offer will say that you will make a deposit (usually 10% of the purchase price) as earnest money to show you are serious about the deal. This amount is usually deposited within 10 or so days of the accepted offer.

Counteroffer

The seller can counteroffer, giving a price above what you offered. Then you can go back and forth until you have a final agreed-upon price.

Hiring a Lawyer

Most people advise getting a lawyer involved before making an offer. Even though the offer is just a small part of the overall transaction, it is still important and best left to a legal professional.

Our real estate agent had an offer template that had too much information in it, in our opinion. We wanted it simpler and more open ended so that we wouldn’t be limited later in the process.

Purchase and Sale Agreement

Overview

Once you have a signed offer, your lawyer can start drafting the purchase and sale agreement (P&S).

The P&S is the formal, legally binding contract between you and the seller, so it’s important that it includes all necessary details.

In our P&S, we wanted some of the furniture that was in the house during the showing, so we made sure to write that in.

Payment Method

The P&S will have details on how the transaction will be funded.

If you have bank accounts in Costa Rica and plan to use that money for payment, then you will be able to make a simple in-country transfer at the time of closing.

However, many foreigners keep their money elsewhere. Because of money laundering laws in Costa Rica, it is not advisable to try to wire in large sums of money from a foreign bank account.

We have heard horror stories of people’s money being held up for months by banks in Costa Rica. They require detailed documentation about where the money came from and do not release it until they are satisfied that the money was lawfully obtained.

If you plan on using a foreign bank account, your lawyer and real estate agent will probably suggest using an escrow company.

These companies facilitate the transaction by receiving money from the buyer, holding it in a separate bank account, and then transferring it to the seller at the time of closing. If the deal falls through for some reason, the money will be given back to you according to the terms of the P&S. See below for more on escrow companies.

Closing Date

The P&S will set a closing date. Since most deals are cash deals and you don’t have to worry about delays from a lender, many are done in as little as 30 days. We did ours in just over a month.

Due Diligence

The final important piece of the P&S is that it provides a due diligence period. This allows the buyer to do a home inspection to make sure there are no hidden defects, surveys, and things like that.

It also allows the buyer’s lawyer the check the property for liens, encumbrances, and any other legal issues that could cause a problem in the future. Usually, the seller is asked to provide documentation, such as recent utility bills, proof of payment of property taxes, etc.

Real Estate Agent Fees

The P&S also will say who is paying the commission for the real estate agents.

In Costa Rica, the commission can be 3-10% of the purchase price. Typically, it’s around 5-7% (plus 13% tax on the commission amount). This is split between the buyer’s and seller’s agent.

By default, the seller pays the agents’ commission, though the buyer can agree to take on some of the expense.

Closing Costs

The P&S should detail the closing costs. These include notary and attorney fees to transfer the title, registration fees, taxes, and government fees. They are calculated based on the purchase price and are around 4%.

Traditionally, the buyer and seller split closing costs. Now it seems that more often, buyers are paying the closing costs, and the seller pays the real estate agents’ commission. But this varies based on what you are paying for the property compared to the listing price.

The notary and attorney fees are separate from your own legal fees. The cost for your lawyer to prepare the offer, draft/review the P&S, etc. are billed separately.

Escrow Agreement

You will need a separate escrow agreement if you’re using an escrow company to get your money into Costa Rica. It will be between you, the escrow company, and the seller as well.

This agreement is fairly detailed and gives the escrow company the legal permission to be appointed as your escrow agent. It describes when the money will be released to the seller and includes specific bank details.

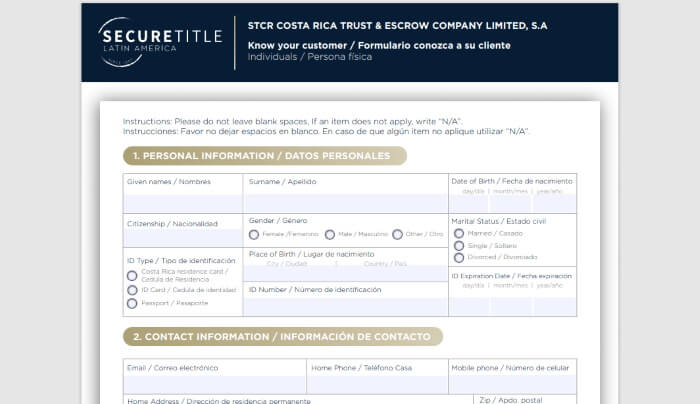

It also gives each party’s obligations. The buyer has to provide documentation so that the escrow company can be sure that the money has been lawfully obtained. These are the documents typically required:

- 2 forms of government ID – A passport is fine. You do not need to be a Costa Rica resident to purchase property.

- Utility bill showing current address

- Proof of income supporting transaction amount (tax returns or W-2s along with six months of bank statements)

- Bank reference letter – See below

- Know Your Customer Form – This form is standard in Costa Rica. It asks for basic personal information, like your address, occupation, annual income, and where your funds came from (work, investments, inheritance, etc.).

Our Experience with Gathering the Escrow Documents

Getting all the documentation was easy for us, except the bank letter.

The escrow company wanted the letter to state the age of the account, average balance, and be signed by a bank representative. Our bank, Capital One, only issued automatically generated letters that were not personally signed.

To get a signed version, we would have needed to go to a bank branch in the United States. Since we live in Costa Rica, this would not have been easy. Luckily, the escrow company ended up accepting an unsigned version.

Escrow Companies

There are a few escrow companies in Costa Rica. The largest, which we used ourselves, is Secure Title Latin America. They have an office in San Jose.

We started out using a smaller company, but they were getting essential details wrong in the escrow agreement (even the purchase price!) so we quickly changed to STLA.

Escrow companies typically charge $600-700 to do a transaction, plus 13% tax.

Closing

This was the really stressful part for us.

We were waiting on some documents from the seller in order for our lawyer to finish the due diligence. Without the due diligence report and knowing that everything checked out legally with the property, we couldn’t close on time. So we ended up pushing back the closing date by a few days.

The closing itself was very simple. We went to the escrow company’s office in San Jose. There, a notary had the title transfer document ready for us and the seller to sign. It was only a couple of pages long—much different than when we had purchased property in the United States and needed to sign a tall stack of papers.

After we signed, the escrow company released the money to the seller, and we got the keys. We are now happy homeowners and can’t wait to move in! We are still doing some renovations, which we’ll tell you more about soon.

After closing, the notary presents the transfer document to the Registro Nacional (National Registry), and the purchase is formally recorded. You can check the Registry’s website to make sure everything was property recorded. It shouldn’t take more than a couple of weeks.

Note: To use the National Registry’s website, you’ll need to create an account. Once you’ve done that, go to “Consultas Gratuitas,” then “Consultas por Numero de Finca.” Enter the province and your finca/plot number, and the property’s current registry information will come up.

Problems We Encountered and Tips for Buying a House in Costa Rica

Lawyers

Overall, the process for us was fairly good. However, like many things in Costa Rica, it can be slow. We were waiting for the due diligence report from our lawyers until the very last minute, with the closing date approaching, which was quite stressful. We had one major legal issue outstanding that could have stopped the sale completely. It would have been nice to have that resolved much sooner in the process.

In our experience, lawyers in Costa Rica are not as experienced and knowledgeable. That doesn’t mean that there aren’t awesome lawyers out there, there definitely are, but they can be harder to find.

You’ll want a lawyer who speaks English most likely, which narrows it even more.

The law in Costa Rica seems less definite in many ways as well. For example, in the United States when a title search is done, you can go online to review a property’s chain of title. For any outstanding title or other issues, lawyers can search caselaw dating back hundreds of years to find an answer. In Costa Rica, some things like taxes and other liens can be reviewed online, but much less is available in general.

When buying a house in Costa Rica, having a lawyer who is not only knowledgeable and experienced in real estate, but also responsive, is another essential. We have heard of many lawyers who do not answer their phones or emails, and when they do, it still takes them way too long when something is pressing.

There are lawyers in San Jose, or you could ask around locally to see who other people have used. Your real estate agent may also have a recommendation.

Bank Transfers

Another difficulty we had was with sending the money. Our bank (Capital One) made it extremely difficult to send the money to the escrow company using our regular online banking. The escrow company had a bank account in the United States, where our bank was located, but we still needed to have a security code sent by text message.

Although we have Magic Jack for international calling, it does not allow for automatic text messages. We tried to have a family member receive the text, but that didn’t work either. Eventually, we had to call the bank’s wire department and make the transfers by phone.

This required uploading documents to verify our identity to their secure portal and being on the phone with them for hours at a time! Not everyone who we spoke to understood the process of doing a wire transfer by phone. But once we got ahold of the right people, the process was fine.

We did have to wait a bit. They did not do the transfers instantly. Rather, after we requested it, they called a few hours later to confirm the transaction.

The process probably differs a lot by specific bank. Just keep in mind that when you go to make a transfer, it may not happen right away. So avoid sending money close to those P&S deadlines, if possible.

Conclusion

Even with the stress of buying a house, we are still thrilled to be homeowners! It is wonderful to have a place of our own for our family. We hope this post helped answer some of your questions about buying a house in Costa Rica.

Pin It for Later

Have a question about buying a house in Costa Rica or want to share your experience? Leave a comment below.

Looking for more information about living in Costa Rica? Check out these posts:

FAQs About Moving to Costa Rica – Learn the basics of moving. Covers residency options, buying a car, renting vs. buying, and ways to make money.

Where to Live in Costa Rica: Planning Your Research Trip – Living somewhere full time is a lot different than vacationing. Check out these tips on what to look for in the areas you are interested in.

Building a House in Costa Rica – Weighing the pros and cons of buying vs. building? Check out our post to see what’s involved in building a house.

Starting a Business as an Expat – We had a company in Costa Rica for several years. Read our post for our experience and important things to look out for.